New Zealand is increasing its spending to 2% of GDP, strengthening its military industry, and forging alliances to counter China’s rise.

Summary

New Zealand plans to almost double its military spending to 2% of GDP within eight years, injecting NZ$9-12 billion. The plan includes a Defense Industry Strategy requiring foreign suppliers to engage locally, the creation of a NZD 100-300 million fund for advanced technologies, and enhanced cooperation with Australia, the United States, and the Philippines (via a guest forces agreement). This ambitious strategic shift aims to counter Chinese expansion in the Indo-Pacific region by transforming Wellington into a credible player in collective defense.

The geostrategic context and Wellington’s motivation

In recent years, New Zealand has relied on a very modest military budget of just over 1% of GDP. This situation reflects a security tradition based on geographical remoteness and reliance on alliances, but it is now considered insufficient in the face of rapid changes in the Indo-Pacific strategic environment.

The authorities emphasize that China’s rise has been accompanied by naval buildup, contested actions in the South China Sea, and provocations in the Indo-Pacific region. Chinese patrols in the South China Sea and passages through waters near Australia and New Zealand are causing concern in Wellington. The government cites these challenges as key motivations for the increase in national defense spending.

It is in this context that Prime Minister Christopher Luxon has announced plans to increase military spending to 2% of GDP within eight years, with an initial plan of NZD 9 billion over four years. This redeployment marks a strategic shift: New Zealand is seeking to move away from a passive defensive posture to become a credible player in regional security.

The financing plan and industrial reforms

Amounts and timetable

The plan provides for an additional commitment of NZD 9 billion over the next four years (more than USD 5 billion) to enhance the capabilities of the NZDF (New Zealand Defense Force). The overall plan is set out in a 15-year document, but it focuses primarily on immediate investments to address the most acute shortcomings.

The increase to 2% of GDP is planned for 2032/33, which will exceed this threshold for the first time since the 1980s. In fiscal year 2023, military spending represented approximately 1.2176% of GDP according to World Bank data.

Public procurement reform and local development

A key element of the plan is the Defense Industry Strategy, which now requires international suppliers to include commitments to local companies in their bids. This aims to stimulate the national industrial base, which is currently underutilized and overly dependent on imports. There are around 800 defense-related companies in New Zealand, but few have access to major markets.

In addition, a fund of NZD 100-300 million will be dedicated to advanced military technologies, including drones, AI, robotics, and sensors. The drone sector already has a commercial presence: New Zealand companies such as Syos Aerospace have signed contracts worth USD 40 million for Ukraine. Other local firms supply training drones or components, demonstrating that the capacity to move upmarket exists.

This strategy requires efforts to upgrade technological skills, diligence in technology transfers, and adaptation of local SMEs to the defense sector—a challenge in terms of financing, certification, and security.

Strengthening military capabilities

The plan is not limited to industrial reorganization; it includes targeted purchases to fill operational gaps.

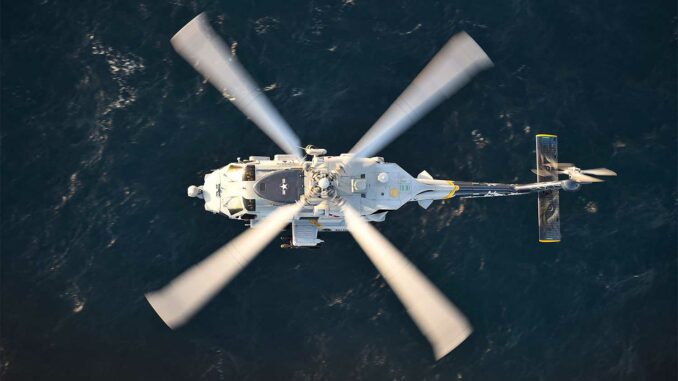

Aircraft, helicopters, and air fleets

According to the most recent announcements, New Zealand will invest NZD 2.7 billion in the acquisition of five MH-60R Seahawk helicopters and two Airbus A321XLR aircraft to replace aging Boeing 757s. These acquisitions meet the needs for maritime surveillance, air projection, and renewal of obsolete equipment.

This equipment will be purchased through the US Foreign Military Sales (FMS) program, avoiding a general call for tenders. The choice is explained by the need to accelerate processes in a pressing strategic context.

Exercises and cooperation: Talisman Sabre

New Zealand is participating in Exercise Talisman Sabre 2025, one of the largest multinational military exercises ever held in Australia, with more than 40,000 personnel from 19 nations. The NZDF has contributed in all areas: land, naval, air, cyber, and space forces. This participation is described as the largest ever by Wellington.

The operational objective is to train interoperability with partners, test multi-domain scenarios (land, sea, air, space), and demonstrate the ability to integrate with regional command architectures (such as the US CJADC2 concept).

Visiting Forces Agreements and Partnerships

Wellington has signed the Status of Visiting Forces Agreement (SOFVA) with the Philippines, allowing their forces to conduct joint exercises or mutual deployments. This legal agreement is similar to the one between Manila and Japan, but it represents an extension of New Zealand’s strategic influence.

In the Pacific, New Zealand cooperates regularly with Australia, the United States, and Japan. Its geographical position makes it useful as a logistics hub or relay for operations in the South Pacific.

Issues, risks, and challenges

Implementation capacity and budgetary constraints

Allocating 2% of GDP to defense requires prioritization in a country with significant budgetary constraints. Funding for social commitments, health, and education could come under pressure with this increase in spending. The government describes the NZD 9 billion as a “floor, not a ceiling.”

Furthermore, converting commitments into actual capabilities—recruitment, maintenance, logistics, training—is a challenge. The effectiveness of spending is also crucial: spending a lot without strategic alignment could result in unusable or redundant equipment. The case of Greece is often cited: despite high spending, efficiency was limited.

Risk of provocation and Chinese reaction

This rise in power is a clear sign of rebalancing in the region, but could also be perceived as provocative by Beijing. China could respond by strengthening its naval deployments, conducting operations in disputed maritime areas, or exerting diplomatic pressure.

Wellington must navigate between strategic assertiveness and cautious management of bilateral relations. If the balance is poorly managed, there could be risks of local confrontation, maritime escalation, or targeted cyberattacks.

Industrial transition and external dependence

Even if the strategy requires local participation, New Zealand will remain dependent on critical components (radars, missiles, engines, etc.). Technology transfer and skills development are long, costly processes subject to international restrictions (particularly on the export of sensitive technologies).

The ability of New Zealand SMEs to comply with security standards, finance development cycles, and integrate into international supply chains represents a challenge.

Strategic orientation: simple support or autonomous actor?

Wellington assumes that its strengthening will serve to ease the pressure on its major allies (the United States and Australia). But to what extent will New Zealand be able to play an autonomous role in the event of a major regional crisis? Dependence on allied command structures (CJADC2, interoperability) risks anchoring New Zealand in scenarios decided elsewhere, rather than allowing it sovereign leeway.

Outlook and scenarios

High scenario: New Zealand as a credible player

If the plan is executed well, New Zealand could enter the category of second-tier defense states, capable of projecting proportionate force in the South Pacific region. It would become a credible operational link in allied architectures, reducing dependence on the United States or Australia alone for certain missions.

Intermediate scenario: slow progress

Administrative delays, inefficient budget absorption, or local industrial resistance could delay or limit the increase to 2%. The country could become a more strategically visible Ulysses, but still insufficiently autonomous.

Pessimistic scenario: tensions and adverse reactions

If Beijing reacts aggressively (through increased maritime presence, exercises, or demonstrations of force), New Zealand could be drawn into distant confrontations. Despite efforts, its army remains small in number (approximately 10,000 active personnel); its ability to sustain itself over time in a major conflict remains weak.

New Zealand is making a strategic break with its security history: from a militarily isolated country, it now aims to enter the regional defense arena. Its plan, combining increased spending, public procurement reform, support for local industry, and multilateral commitments, is consistent with the growing tensions with China.

Implementation will be decisive: spending efficiency, local industrialization, regional cooperation, and the ability to avoid provocations will all be factors in its success or failure. In a world where distance no longer guarantees security, Wellington is trying to make its voice heard.

War Wings Daily is an independant magazine.